17% of rural farms have a reliable outdoor mobile signal in all locations and 73% still get their internet over copper wire. In addition to undulating topography and poor infrastructure, it is no surprise that current methods focus on a manual monitoring technique for cattle lameness.

Red Tractor Dairy Standards 2021

What is the problem to be solved?

- According to the AHDB, just under a third of all dairy cows may be experiencing some degree of lameness at any one time.

- The average cost of an incidence of lameness, in terms of treatment costs, loss of yield and potential for shortened productive life of the cow may be in the region of £330, which at current levels equates to nearly £15,000 for an average-sized herd (AHDB Figures).

- Assessing lameness manually is a time-consuming process but can deliver additional margin per litre on milk sold.

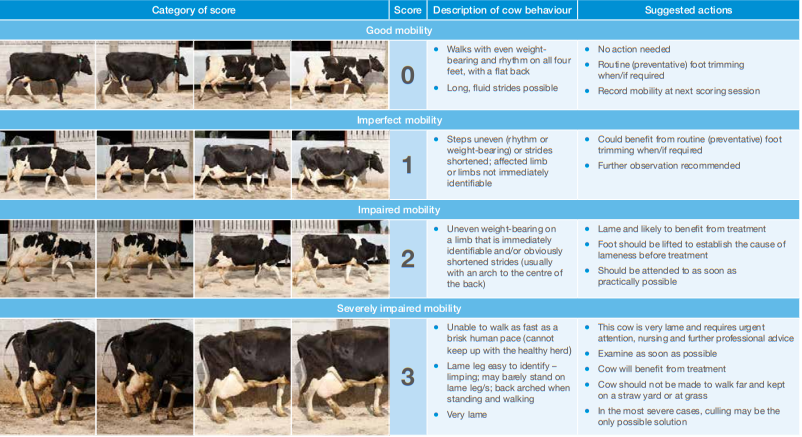

- The manual process involves a trained observer identifying the cow, and watching it walk a few strides in a well-lit, flat and non-slip surface. Scores from 0 (good mobility) to 3 (severe lameness) are attributed by a trained observer.

- There is obvious opportunity for variation between different observers.

- Most supermarkets and milk processor contracts require mobility scoring every 3 months (Promar International) and mobility scoring has been included in the Red Tractor Dairy Assurance Scheme since 2013 (Bristol University).

- The presence of wireless connectivity still varies drastically between urban and rural areas. According to Ofcom’s 2021 Connected Nations report c. 79% of UK landmass had 4G coverage in 2021 1. This contrasts coverage of 99% to urban premises. The industry which is most affected by these statistics is agriculture. Although the industry might only currently provide less than 1% of UK GDP, it supports many other important sectors (such as food and drink) with a combined value of £113bn.

4G cannot provide sufficient coverage across farmland

a) Only 79% of UK landmass is currently covered in 4Gb) MNOs don’t have any commercial incentive to reach unpopulated areas

c) Smaller operators don’t have the capability to provide standardised services

What is the solution to the problem?

Looking at the hardware:

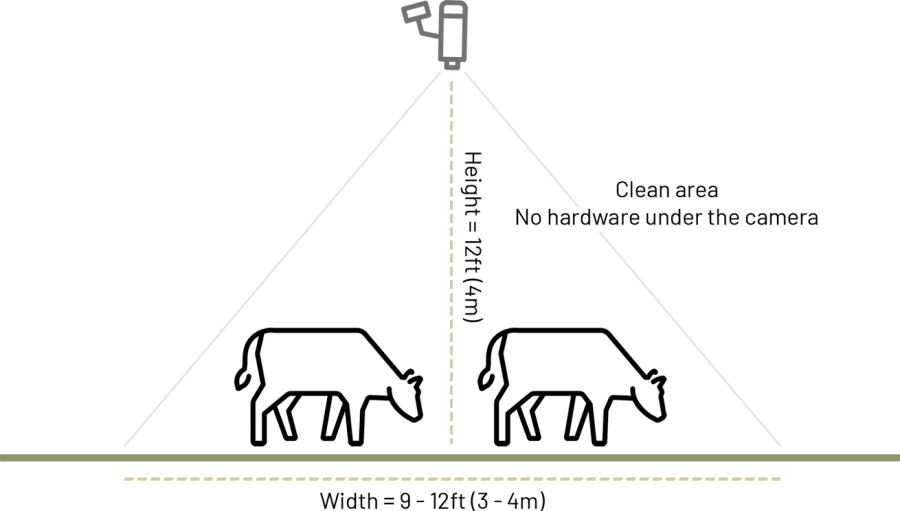

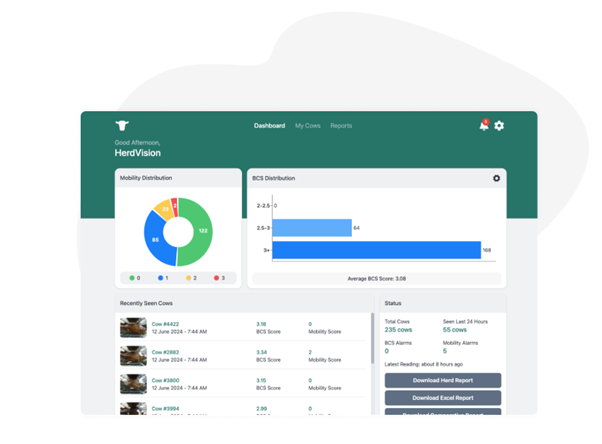

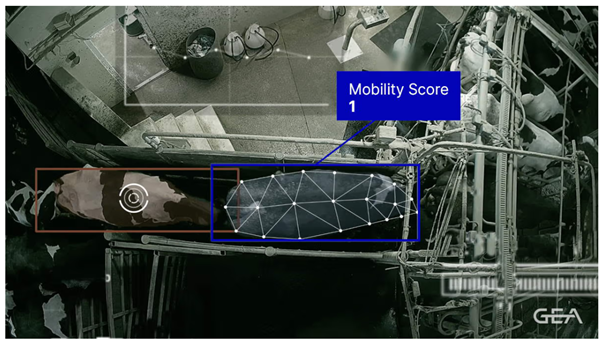

- HerdVision or Cattle Eye produce a 3D camera that watches cattle walking out of the milking parlour from overhead. These are mounted at a height of c4m and need a clear line of with no hardware getting in the way along a 4m length of passage. This ensures the cattle are single file. The camera is then able to identify each individual cow by the markings on their back together with data from the parlour’s electronic identification system (EID) and produce a mobility score. There is no need to ear tag or attach anything to the cows.

- These systems require Wi-Fi or 4G and power, albeit low voltage, so various power options exist.

Looking specifically at the comms provision: - 3.3-3.8GHz spectrum (also referred to as band n78). The large MNOs have unique access to band n78 through high-value auctions, whereas band n77 is available for other network operators at an appropriate price, on a case-by-case basis.

- 3.3-4.2GHz (band n77) is probably the most interesting for other network operators. The propagation and service provided is similar to that of n78 spectrum but there is the possibility of operating a commercial service over this equipment (as ‘Shared Access’ licences are available in n77).

- Servers moved to a central location and running multiple masts off a single server located up to 10km from the mast. As farms are usually located in one geographical area, this could provide a huge cost saving – nearly £10,000 per mast site (1/5th of the cost). Each farm can have a network of masts all fed by a single cabinet.

Commercial model (Business Case)

What are the financial returns available? Savings or efficiencies?

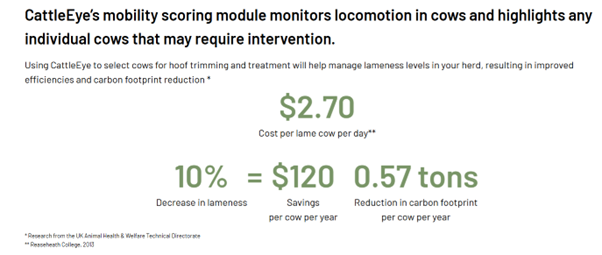

Total current cost of lameness in the UK is estimated to be in the region of £30 per cow, representing a potential total annual cost of £15,000 for an average sized herd.

Financials

Year 1 £2,653.50

Year 6 £15,121.00

Figures based on overall cost of lameness, minus the additional expenses in combating this, mainly the cost of Cattle eye subscription.

Benefits

Financial

Annual savings of up to £330 per cow possible

Economic

Reduction in time spent manually mobility scoring, although some of that value relies on efficient cattle handling infrastructure being available.

Continued compliance with key producer schemes (critical to future business).

Efficiency

Staff time previously spent on mobility scoring can be spent on improving other areas of the business.

Early intervention is possible because symptoms are spotted earlier and are therefore cheaper to treat with less significant intervention.

Cattle who are good on their feet can take advantage of good grazing further away from buildings.

Safety

There are minimal direct impacts on safety from this initiative, but an efficient farm is generally a safer one to work on.

Health

There are no direct impacts on human health, but spotting symptoms early will be very much better for animal welfare.

Energy or de-carbonisation

Improved mobility scores mean fundamentally more efficient milk production, which means milk produced with a lower carbon footprint.

Comfort & Convenience

This is rather more a question of comfort and convenience for the animals than the humans.

Pollution

More efficient milk production means reduced emissions.

Social

Automated mobility scoring means it is less onerous to deliver the requirements of milk supply contracts.

Lessons Learnt

Referencing previous services/products that failed or were successful, including contacts if applicable.

CattleEye is being distributed in the UK by GEA. As of November 2024, CattleEye is being actively used on 105 farms. This is clearly only a very small proportion of the 7,130 dairy farms in the UK.

Arla approved the CattleEye system for use in their Arla UK 360 Programme in May 2023. A total of 2,100 UK farms supply Arla, and some of these are in the Arla UK 360 programme and receive a price premium for their milk.

HerdVision publish 3 testimonials on their website but there is no further data available on the number of implementations to date, although they are clearly actively promoting.

Previous experiences implementing the use cases.

Unreliable connectivity will make the system unusable. Verify that there is a stable connection available at the planned installation location (and that there is a clear arrangement in place to cover any outage).

Guidance on supplier selection

It is important to choose a supplier that is approved by the dairy or supermarket buying milk from the farm.

It is important that the supplier is able to provide data in a way which is accessible to the farm.

After-sales back up will be critical, and as algorithms will be being refined constantly, this will become something of a partnership with the farm customer.

Procurement considerations

If there is a cost per cow for implementation, it is important to understand how long this cost is locked in for and what might happen to the cost in the future (the farm will become dependent on the service and there is not much competition at present).

It is also important to understand the level of price premium for improved welfare being offered by the customer buying their milk (and the duration of this arrangement).

Guidance on maintenance and support options

Maintenance will be critical, even if this is just cleaning the camera, so safe access at height will be required.

It would be sensible to install bird deterrent measures to prevent birds alighting on the camera.

Discuss maintenance packages and Service Level Agreements with potential suppliers (bearing in mind the distance between their service location and the potential installation).

If you’re ready to embark on a connectivity project, we can point you to the suppliers with expertise in your sector.