Image courtesy of Ericsson

What is the problem to be solved?

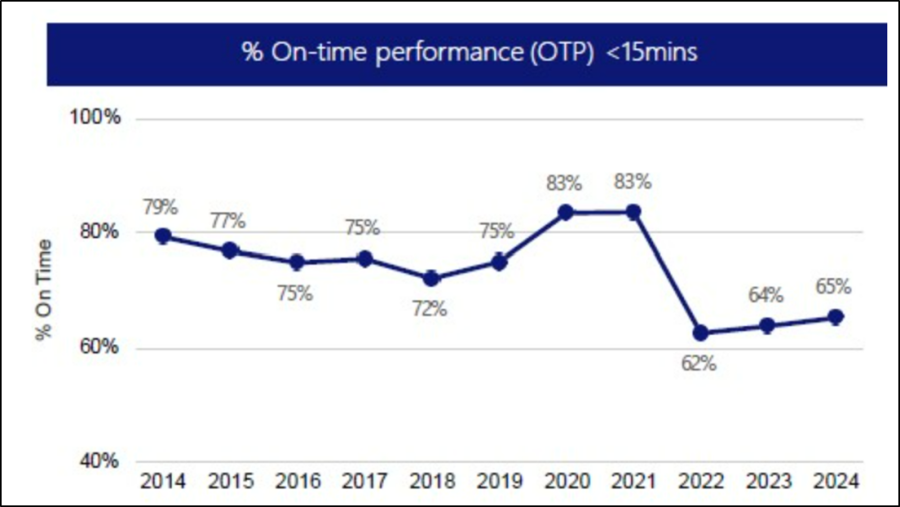

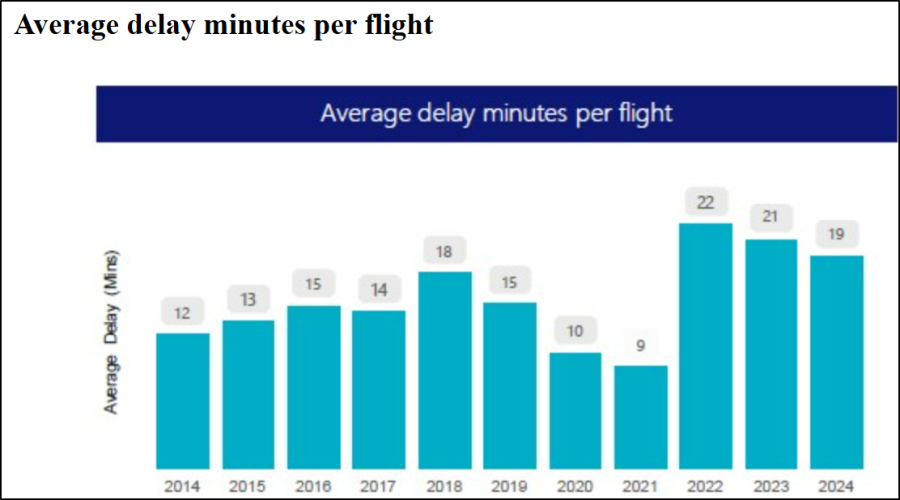

Airport PASSENGER numbers in the UK during 2024 were at 226 million vs 300 million in 2019, according to CAA, with a substantial drop experienced during COVID (2020/2021), to ~70 million due to travel restrictions. The industry is recovering but overall is still not back at pre pandemic volume across UK airports.

UK Airport CARGO transported in the last few years has dropped from a peak in 2019 of 2.8 million tonnes to 2.0 million in 2024 and has been on a downward trend in the last 5 years, according to CAA data.

In addition to trade volumes for cargo and passenger numbers, meeting sustainability and CO2 targets by 2040 as outlined in the “Jet Zero Strategy”, in 2023 2040 zero emissions airport target - GOV.UK is providing further funding and technology challenges.

There are 40 substantial commercial airports in the UK which account for the majority of passenger and cargo freight. The range of airport sizes reflects the diverse needs for travel and transportation in locations across the UK.

What is the solution to the problem?

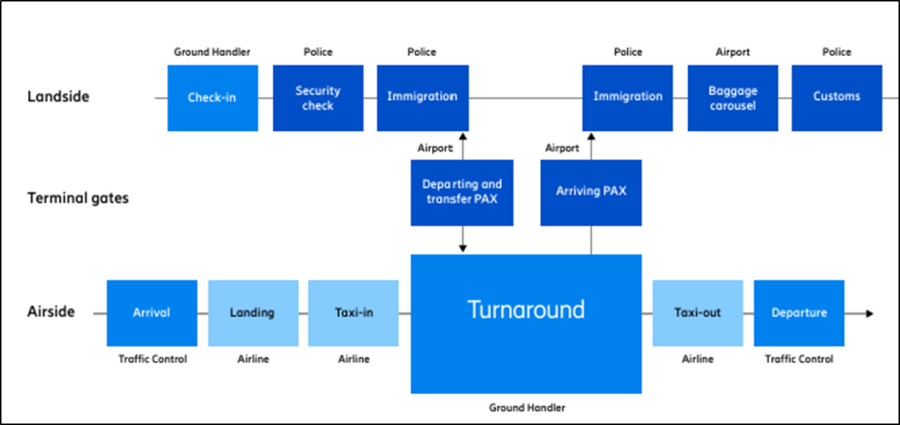

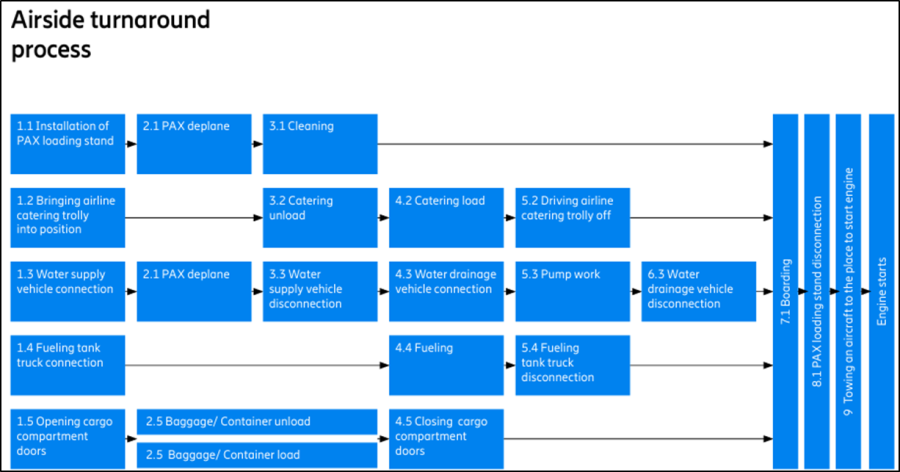

Having insights over airport operations both in the airport and airside with the aircraft is key. Having control over the complete chain of collaborating parties through digitalization will maximize capacity, efficiency and on time performance.

To generate good insight data, robust mobile connectivity is required with products and services operating seamlessly and integrated together, sharing data and sensor hardware.

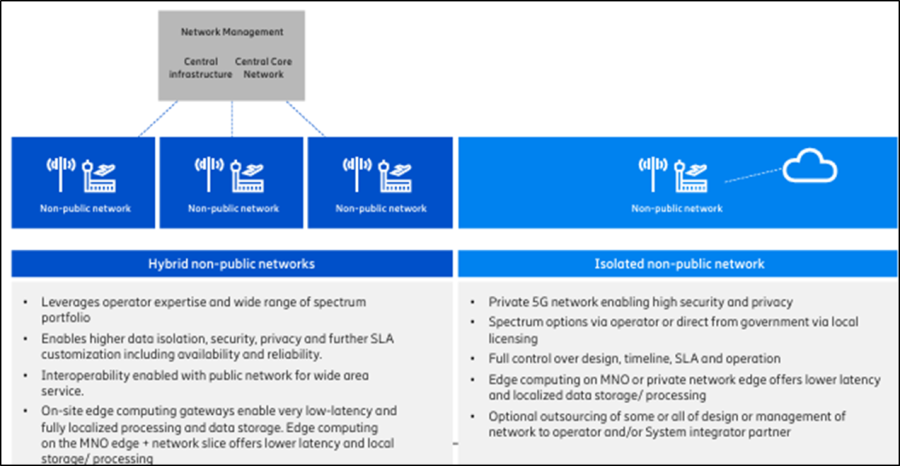

For all applications to function effectively they need high-performance, low latency and high reliability connectivity which a 5G wireless network can provide. 5G is designed for flexibility of device and connection with security built in.

Commercial model (Business Case)

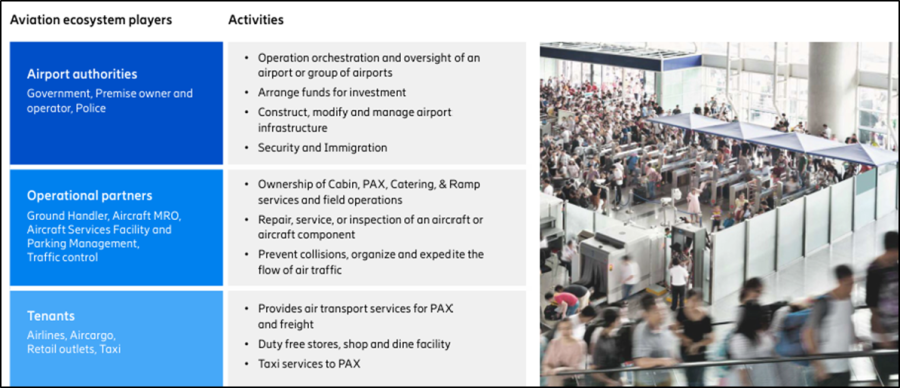

Aviation is a key industry on which much of the global economy depends. It enables connections between people, cultures and businesses across continents, allowing local communities and businesses to access global markets. All the many stakeholders who make up this industry – such as airports, airlines, ground handlers, governmental bodies, retail, aircraft and MRO (maintenance, repair and overhaul) providers – together contribute $2.7 trillion to the global gross domestic product. The industry is an essential component of the U.N. 2030 Agenda for Sustainable Development.

Benefits

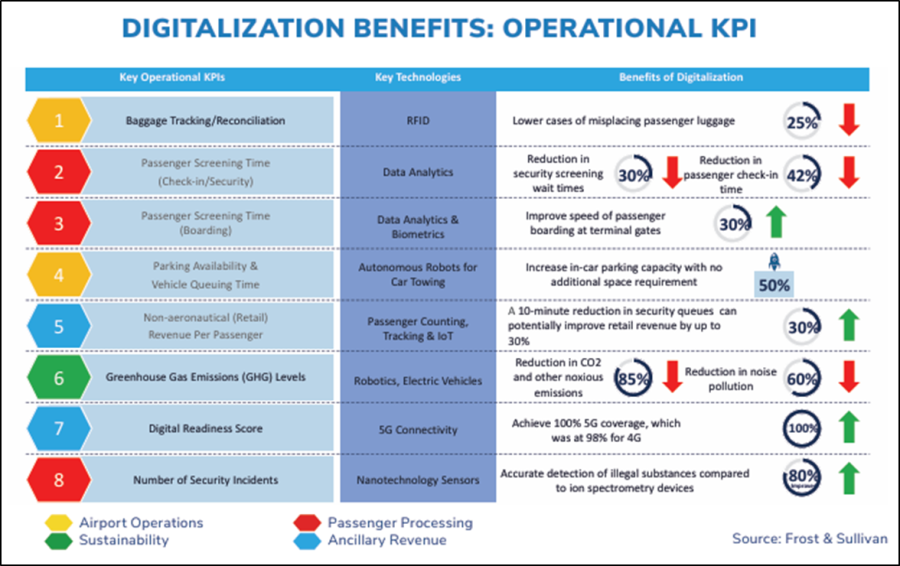

According to Frost and Sullivan, Airport Show 2022, “focus of airports is on optimized operational planning and management at strategic and tactical levels, enhanced passenger flow, and asset management through all stages of the airport journey”. They surveyed 50 airports of different sizes worldwide highlighting where digital can have the biggest impact.

Lessons Learnt

There are two key organisations leading policy, safety and representing the airports across the UK. These are the CAA (Civil Aviation Authority) and AOA (Airports Operators Association) which is now Airports UK.

There are many publications detailing the opportunities and challenges in airports in the UK. These include business case background and mobile connectivity implementation suggestions. There are a selection of publications listed below:

Airports UK (was Airport Operators Association: AOA)

Discussion of the recovery plan for UK airports post-COVID-19, emphasizing the importance of digital connectivity and operational efficiency. Airports UK reconnecting-aviation

UK Civil Aviation Authority (CAA)

Main CAA website with links to multiple sources of information …. Civil Aviation Authority

Specific guidance around Innovation in airports…. Updates and guidance from our innovation team | Civil Aviation Authority

Airport Technology publication

From Terminal to Take-Off: The Role of Connectivity in Modern Airports - This article highlights the significance of in-building mobile connectivity at airports and how it enhances the overall passenger experience. Role of connectivity in airports - Airport Technology

Ericsson:

Connected Aviation background and benefits of good mobile and digital connectvity… https://www.ericsson.com/en/enterprise/reports/connected-aviation

Frost & Sullivan

If you’re ready to embark on a connectivity project, we can point you to the suppliers with expertise in your sector.