Image courtesy of Ericsson

What is the problem to be solved?

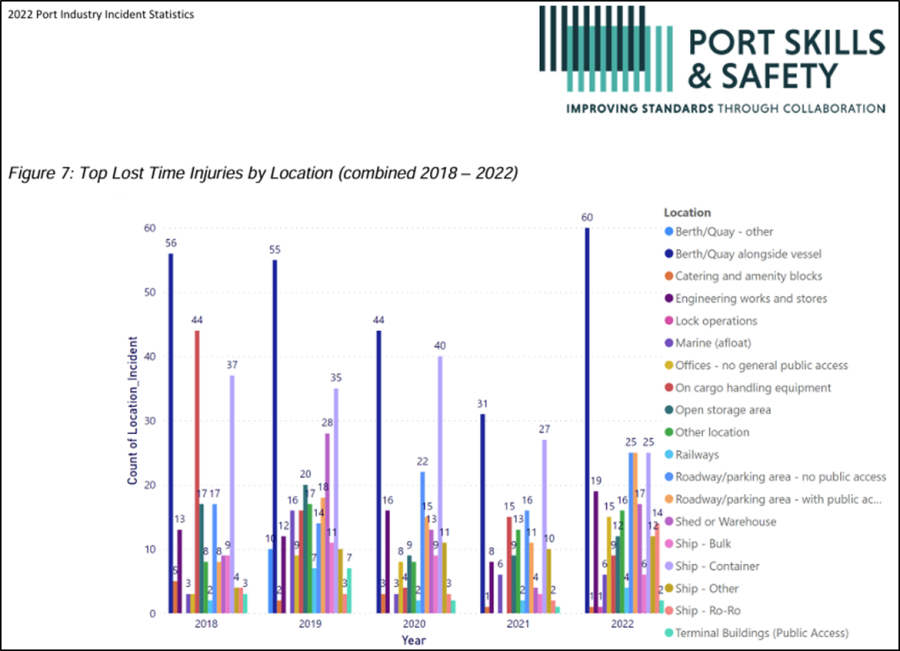

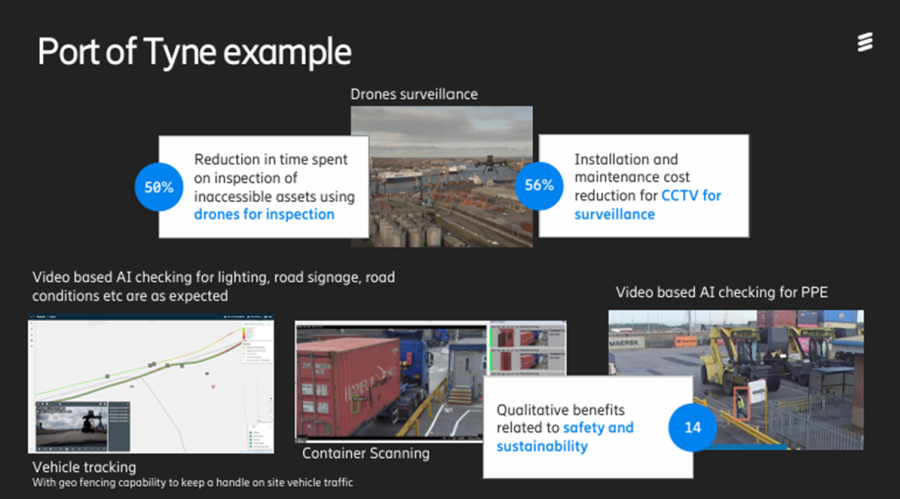

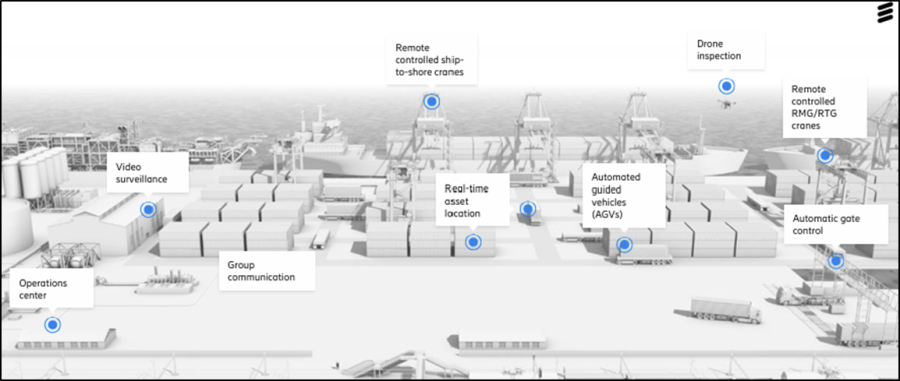

As a fundamental enabler for the evolution of modern maritime port operations, digital communications not only respond to demands for the safe exchange of data, but also contribute to the efficient management of the movement of people and goods. Ports worldwide are already adopting new technologies in a bid to increase productivity and provide better, more cost-effective services to customers. It is therefore vital that UK ports follow this initiative to remain competitive.

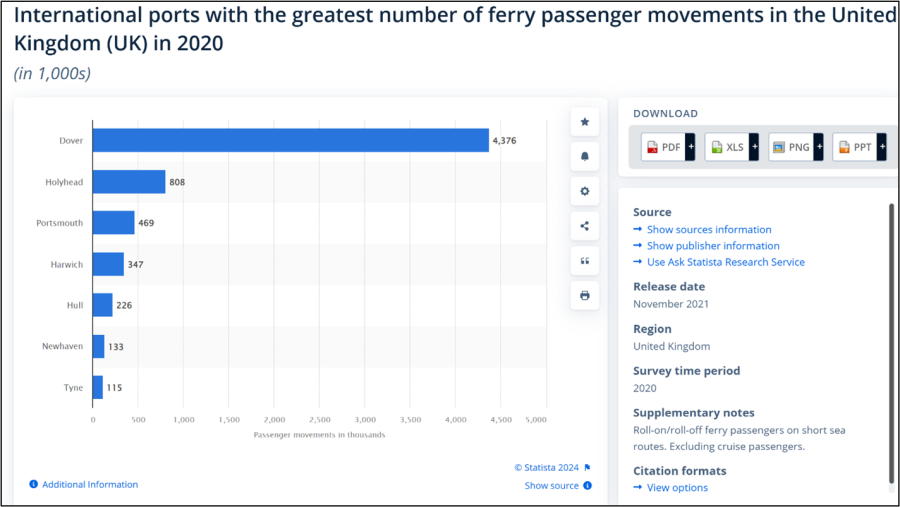

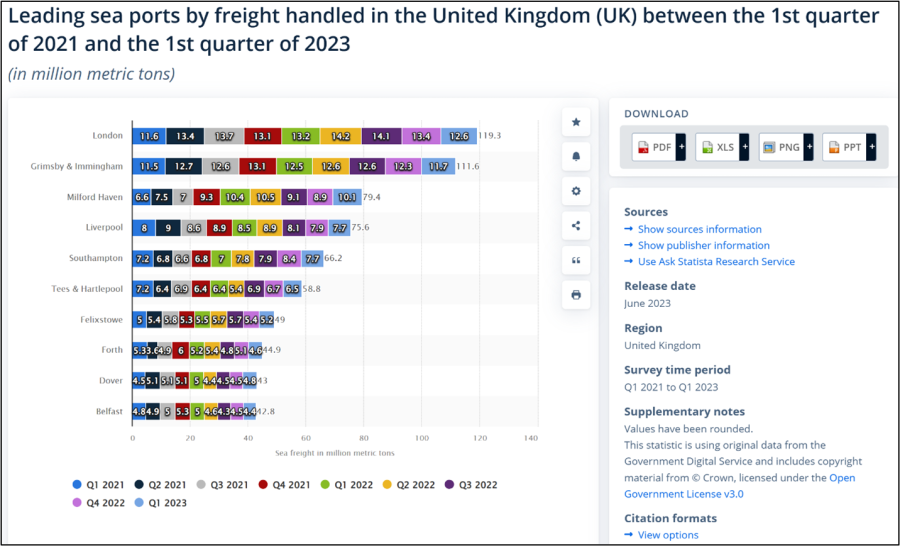

Ports are an interface between UK trade and transport with the digital interface a significant consideration for frictionless operations. Ports are a hub for the movement of goods and people.

The largest ports in the UK, such as Port of Southampton, Port of Felixstowe, and Port of London, handle more than 18 million tonnes of containers, 6.5 million passengers, and over 800,000 vehicle imports and exports annually.

The largest container ships carry over 200,000 tonnes of cargo in over 20,000 containers, so the sheer scale of operation becomes clearer. Managing the movement of this volume of goods involves an array of machinery.

What is the solution to the problem?

Reliable wireless communications are needed across ports to provide connectivity with mobile devices which are increasingly becoming essential to operational processes. Wi-Fi has been utilised in many ports which has benefitted from high availability of devices, but Wi-Fi has limited range of up to 100m and is prone to signal blocking by the harsh port environment. This makes it expensive to provide reliable coverage due to the large numbers of access points required.

Cellular networks require a relatively small number of base stations (masts) with capacity for additional device connections or signal boost to improve “not spots” of connectivity, provided through 5G Small Cells. These Small Cells can be installed on existing lamp posts or similar assets which have power and nearby fibre. Small Cells have a much greater range than Wi-Fi and enhance commercial and private standalone 5G provision, supporting high numbers of device connections (phones or monitoring devices) for example at passenger hubs such as passenger ferry terminals. Overall, a more reliable connectivity is possible using 5G for the harsh transmission environment of ports.

Commercial model (Business Case)

Handling 95% of UK imports and exports, maritime ports are the country’s gateway with international markets. Not only do they generate revenue for a nationwide network of direct and indirect suppliers and service providers, but UK ports also employ around 125,000 people.

Benefits

The benefits of 5G communications and 5G enabled products and services are evidenced from several recent studies.

Lessons Learnt

Private networks and non-commercial spectrum are both appealing concepts for ports to minimise costs, but the fibre connection and power requirements for more rural ports can still present challenges.

If you’re ready to embark on a connectivity project, we can point you to the suppliers with expertise in your sector.