What is the problem to be solved?

To benefit from the growth in digital and connectivity across the UK, the transport network requires a reliable level of service. Public Transport operators, private vehicle owners and freight operators will all benefit from pervasive and robust connectivity across the road network to improve the road infra structure and vehicle efficiency and safety of operation through a variety of digital products and services, many already available.

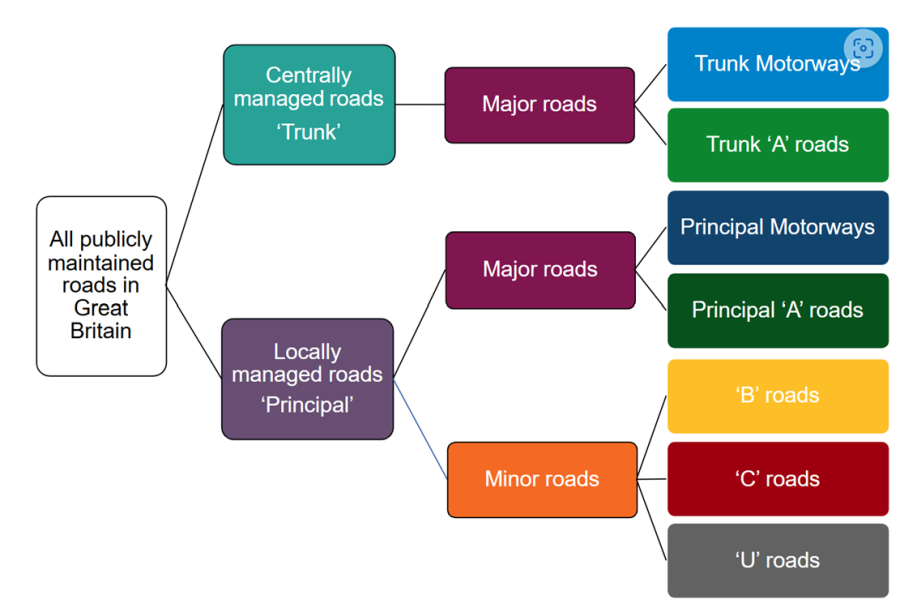

Connectivity across urban & rural roads and the Strategic Road network (SRN, major roads such as motorways) will improve road safety through connected and cooperative driving.

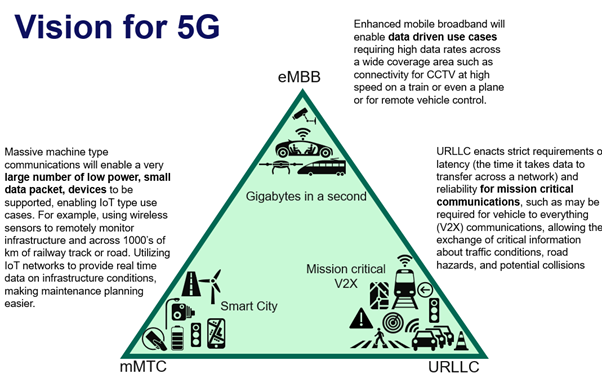

Connected vehicle driving involves vehicles that can communicate with each other (V2V), with infrastructure (V2I), and with other entities (V2X) using wireless technology. The main goal is to share information such as traffic conditions, road hazards, and vehicle status to improve safety and efficiency. Examples include real-time traffic updates, navigation assistance, and alerts about nearby vehicles or obstacles.

What is the solution to the problem?

5G provides the ability to support high data rate devices (such as cameras), a large number of low data rate IoT devices (typically used for monitoring) and the provision of reliable low latency communications. A 5G stand-alone (5GSA) network can divide up the useable frequency range into separate dedicated bandwidths to support critical communications.

A 5GSA network can split frequency bandwidths (Network Slicing) to dedicate a slice to support small data packets from millions of connected devices (e.g. sensors monitoring infrastructure), while simultaneously providing another slice for safety critical services to support self-driving vehicles for cooperative junction management for example.

There are currently no 5GSA networks available on the road network in the UK. The implementation of a 5GSA network on a selection of the road network would allow the demonstration of several new use cases for ITS (Intelligent Transportation Systems) and could be implemented using the radio frequencies of shared spectrum or mobile network operators reusing assets that already exist.

Commercial model (Business Case)

The business case and the market opportunity for investment in robust connectivity to support the extensive UK road network is driven by the efficiency and safety improvements possible as a result of devices and vehicles always being connected.

Benefits

Digital products enabled by available and robust connectivity on the roads make a difference to the efficiency, safety, wellbeing, de-carbonisation, comfort & convenience of transport and pollution. These digital products enabled by robust IoT and 4G/5G networks across various environments are driving efficiency, cost savings and service improvements in both public and private sectors.

Lessons Learnt

To develop the business case for improved connectivity on the UK road network a collaboration between Local Authorities / MNO's / Transport Operators and DfT-National Highways is needed to ensure all aspects of the need, futuring and investment are considered. This is like the approach used to develop the "shared rural network", an initiative launched in 2020.

Small Cells licence agreements can be time consuming and costly to agree. DCMS issued guidance to Local Authorities reference Guidance on access agreements - GOV.UK (www.gov.uk) which has been adopted by many authorities. This “Open licence” approach provides an overarching agreement to apply Small Cells to Lamp posts and other suitable assets across urban environments and has the advantage of a one stop legal agreement. Specific deployments then are between the local Authority Highways teams and the supplier and do not require further legal agreements to be put in place.

If you’re ready to embark on a connectivity project, we can point you to the suppliers with expertise in your sector.