Unlocking the affordable installation of satellite internet terminal antenna systems on UK rail rolling stock.

What is the problem to be solved?

As government and the UK rail industry look to improve Internet connectivity for train passengers, it is likely that a mixture of different technologies and data services will be utilised for train to ground connectivity. These are likely to be chosen around benefit, demand and affordability. This would most likely see a hybrid approach with Satellite services used alongside more traditional solutions e.g. public mobile network operator (MNO) data services (4G, 5G etc). MNO services, on their own, have continued to be an inadequate solution for delivering consistent and high bandwidth data to trains, even with elegant aggregation/bonding techniques being used to maximise service quality.

What is the solution to the problem?

Satellite communications alone will not solve all rail passenger connectivity problems, but it is set to become part of the toolbox of data services that can be used in most open sky railway locations (ie not in tunnels or under station canopies).

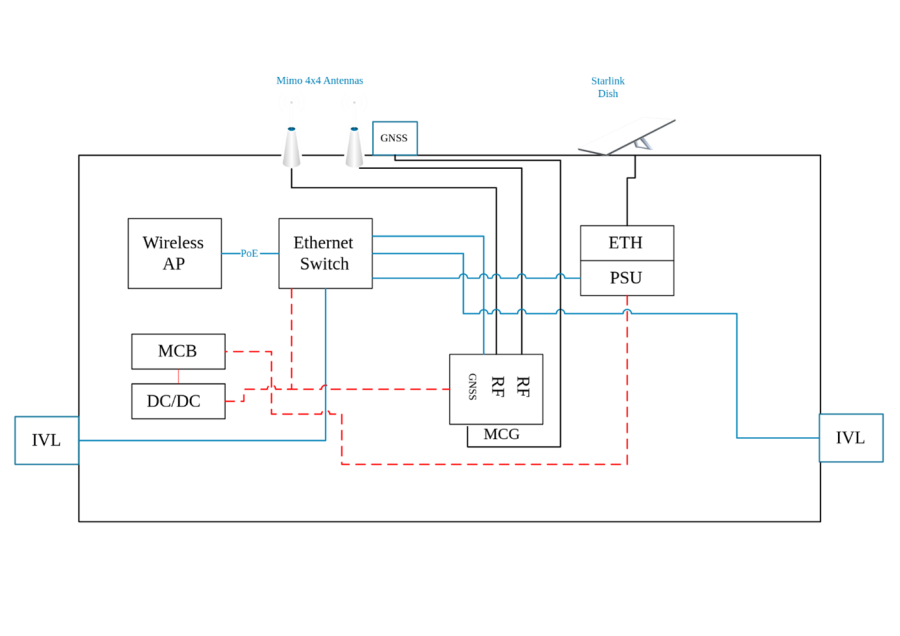

It represents a technology that can be retrofitted to the train and possibly integrated directly into the existing train WiFi system. More specifically, through the existing multi-bearer MCG (mobile communications gateway), which currently uses multiple MNO data modems. The MCG bonds the multiple MNO data bearers and directs traffic based on multiple business rules which can be defined: Latency, Bandwidth, Cost, signal quality etc. An upgraded installation would see the MCG treating one or more satellite communication terminals as additional wireless access networks to work alongside the MNO services.

Commercial model (Business Case)

Determining the business case for satellite deployment in trains will be largely predicated on fundamental research being commissioned to provide the answers to the challenges identified in https://uktin.net/how-to-deploy-5G/deployment-toolkits/transport/On-trainnetwork#

With an understanding of the societal and economic benefits of appropriately connecting train passengers to the Internet, a combination of policy, regulation and funding can be set in-place to incentivise action. This would potentially allow a marketplace of train satellite connectivity integrators to emerge, based upon them determining a viable price point for provision. This surety would also need to be based upon a functioning business model for data service Op-Ex costs possibly being recovered directly or indirectly from the passenger fare box, or by passenger’s service providers (mobile or broadband) offering train connectivity as a value-add option.

Benefits

It is believed that the primary enabler for change will be through UK achieving the societal and economic benefits of appropriately connecting train passengers to the Internet. As previously mentioned, the UKTIN Transport and Logistics WG has recommended to government that research needs to be undertaken to identify and validate these benefits. Well-informed rail policy, an aligned rail industry and a marketplace of satellite connectivity products and services tailored to train use will undoubtedly remove barriers and accelerate change.

Benefits around the connected railway (efficiency, safety, de-carbonisation etc) are understood, and will be delivered though the upgrade of the railway’s 2G GSM-R service to a 5G FRMCS (future rail mobile communications system) service. The increase of data throughput delivered by this migration from 2G to 5G is likely to leave most trackside GSM-R mast sites unable to give sufficient geographical coverage to offer a continuous connection to trains. Whilst the build of infill masts will be viable in some locations, for many more, the resolution of not-spots between existing masts may only be economically viable thought the use of satellite connectivity to the train. This could potentially be a satellite installation serving both railway operational and passenger connectivity needs.

Lessons Learnt

Don’t assume that consumer-grade satellite equipment can be used on trains or assume that because a satellite terminal can be installed on an aircraft, it will also be OK for a train.

Don’t use valuable innovation funds for non-representative rail trials which create false expectations amongst more distant, but nevertheless critical stakeholders.

Don’t assume any technology solution is going to meet the necessary requirements for train deployment in isolation. Despite bold vendor claims for “rail approved” products, collaboration and early stakeholder engagement is the only way to ensure a sustainable rail opportunity for satellite.

If you’re ready to embark on a connectivity project, we can point you to the suppliers with expertise in your sector.