According to the Worldwide Software and Public Cloud Services Spending Guide published by International Data Corporation (IDC), public cloud services spending in Europe will total $229 billion in 2025 and will reach $452 billion by 2029, recording a five-year (2024-2029) compound annual growth rate (CAGR) of 19%.

In a year when efficiency, automation, and revenue generation are transforming business and IT strategies, the interest in adopting AI solutions and in testing and deploying generative AI (GenAI) use cases will support investments in platform-as-a-service (PaaS). As a result, IDC expects PaaS investments to experience a 32% year-on-year growth rate by 2026.

“Despite potential impacts on European public cloud spending in the second half of 2025, including the uncertainty from U.S. tariffs, most European industries are currently maintaining a 'business-as-usual' approach," commented Andrea Minonne, research manager at IDC UK. “While sectors like automotive, consumer goods, chemical, and other manufacturing remain cautious in their spending, the overall industry outlook is not concerning, and we don't foresee a substantial effect on cloud investments. Cloud continues to be crucial for manufacturing, enabling solutions that improve supply chain visibility, facilitate agile inventory management, and deliver real-time demand forecasting to manage market fluctuations.”

European Industries Navigate Macroeconomic and Geopolitical Risks

The macroeconomic and geopolitical situation in Europe presents a few risks that could influence tech-buyer spending in the second half of 2025. These include the war in Ukraine, which has sparked dialogues about increasing defense spending across NATO countries; the conflicts in the Middle East, which might trigger supply chain disruptions for European businesses importing goods from Asia; and the volatility caused by the ongoing dialogues over U.S. tariffs, which might impact verticals like automotive, consumer goods, and other manufacturing industries.

Despite these headwinds, public cloud will remain a strong enabler of key priorities including cybersecurity, which is expected to significantly push spending on security software across European federal and central governments. Regulatory compliance across heavily regulated industries like finance (banking, insurance, and capital markets) and healthcare (healthcare providers, healthcare payer, and life sciences) will also support investments in cloud. Furthermore, automation and GenAI projects will accelerate cloud spending among software and information services companies, which are undergoing significant AI-driven organizational restructuring.

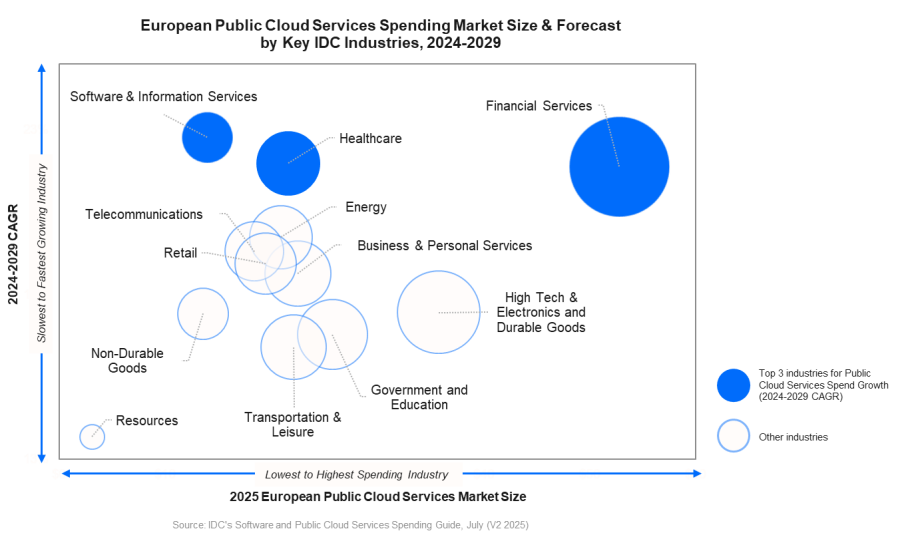

Fastest-Growing Industries Accelerating Cloud Spending

Healthcare payer, insurance, and life sciences will exhibit the fastest acceleration in cloud investments in 2026. In Europe, healthcare payers and insurers will see substantial cloud investment growth as the industries strive to meet escalating customer demand in a scalable, efficient, and secure way. For healthcare payers, whose cloud spending will grow by 25% next year, this is particularly true in countries like the U.K., where National Health Service (NHS) deficiencies like long waiting times are driving up the number of citizens opting for private health insurance. Life sciences investments in cloud will be fueled by massive R&D investments in advanced therapies, significant EU funding initiatives, and accelerated digital transformation for drug discovery and innovation.

About IDC's Worldwide Public Cloud Services Spending Guide

The IDC Worldwide Software and Public Cloud Services Spending Guide quantifies public cloud computing purchases by cloud type for 28 industries and 8 company sizes across 53 countries. This comprehensive spending guide was designed to help IT decision makers clearly understand the industry-specific scope and direction of public cloud services spending today and over the next five years. The spending guides are delivered via pivot table format or custom query tool, allowing the user to easily extract meaningful information about each market by viewing data trends and relationships.

The 28 industries included in the IDC's new industry taxonomy are: Consumer; Banking; Insurance; Capital Markets; Healthcare Payer; Healthcare Provider; Life Sciences; Telecommunications; Oil and Gas; Utilities; High Tech and Electronics; Aerospace and Defense; Automotive; Industrial and Other Manufacturing; Chemicals; Consumer Goods; Agriculture and Fishing; Mining; Retail; Software and Information Services; Travel and Transportation; Hospitality and Leisure; Media and Entertainment; Engineering, Construction, and Real Estate; Professional and Personal Services; Education; Federal/Central Government; State/Local Government.